GST: Goods & Services Tax is to make country run under one tax.

Who is Liable to pay GST:

Empower to Citizens:

GST Compulsory Scenario:

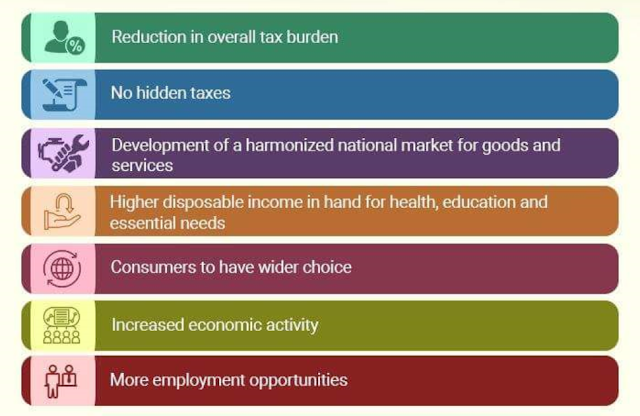

One Tax - Multiple Benefits:

Gross Benefits:

Conclusion:

Objective of GST

Who is Liable to pay GST:

Empower to Citizens:

GST Compulsory Scenario:

One Tax - Multiple Benefits:

Gross Benefits:

So, the idea behind having one consolidated indirect tax:

- There will now single tax on goods & services.

- Level up country's business

- Attract foreign nations and investors who have a more structured tax system

- Benefit end users across the country under one tax plan

- It will also improve the collection of taxes and economy of country.

No comments:

Post a Comment